The golden state's progressing home insurance landscape has been a hot topic for home owners, yet businesses throughout the state are additionally really feeling the impacts. The reforms, made to resolve rising expenses, natural calamity threats, and insurance coverage availability, have presented new obstacles and chances for organizations of all dimensions. Understanding these changes is crucial for entrepreneur, as they browse monetary preparation, threat monitoring, and compliance in an unclear environment.

The Ripple Effect of Insurance Reforms on Commercial Operations

Home insurance reforms are not just about houses. When insurance providers adjust policies, boost costs, or take out from specific markets, the results reach industrial property, organization procedures, and the general economic landscape. Companies that own building, lease workplace, or count on residential property management firms need to stay informed about changing insurance policies and their prospective influence on expenses.

Organizations that rely upon vendor networks and distribution networks may likewise experience disruptions. Higher insurance coverage costs can lead to raised operating costs, which are frequently given the supply chain. When business property owners encounter rising insurance coverage expenditures, tenants may see rental increases, impacting small companies and entrepreneurs one of the most.

For business owners, adjusting to these modifications needs proactive threat analysis and critical planning. Partnering with legal and economic consultants can help companies mitigate unpredicted costs and ensure they continue to be compliant with regulatory updates.

Climbing Costs and the Burden on Business Owners

One of one of the most instant concerns coming from California's home insurance reforms is the rise in expenses. As insurers get used to new danger models, premiums for residential or commercial property insurance policy have actually risen. While house owners are straight affected, organizations that possess commercial areas or depend on domestic markets are additionally feeling the pressure.

Greater residential or commercial property insurance coverage costs can lead to boosted expenditures for entrepreneur who take care of or rent structures. In industries such as hospitality, real estate, and retail, these expenses can dramatically affect earnings. Business need to take into consideration reassessing their spending plan allocations to account for these increases while maintaining financial stability.

Sometimes, companies may need to check out alternate protection choices. This can imply dealing with specialty insurance providers, self-insuring specific risks, or forming strategic partnerships with various other organizations to bargain much better rates. No matter the method, it's vital for business to stay educated and look for specialist support when making insurance-related decisions.

Legal and Compliance Considerations for Employers

Beyond economic worries, regulative compliance is an additional vital element of California's home insurance reforms. While these laws mostly focus on homeowner plans, they can indirectly influence workplace plans, particularly for organizations with workers that work from another location or operate from home-based offices.

Employers should guarantee they are up to date on anti harassment training needs and work environment safety laws, as compliance often converges with broader lawful obligations. Comprehending how altering insurance policy legislations could affect obligation and staff member protections can assist firms avoid possible lawful risks.

Additionally, California organizations need to keep an eye on changes in California workers compensation rates as insurance changes may impact employees' insurance coverage. Ensuring that staff members have adequate defense in case of crashes or property-related incidents is vital for preserving a certified and honest workplace.

Approaches for Businesses to Navigate Insurance Challenges

Adjusting to California's insurance policy reforms needs a positive strategy. Right here are some crucial methods for services seeking to handle the effect efficiently:

- Review and Update Insurance Policies: Businesses need to consistently reassess their existing coverage to guarantee it straightens with new policies and potential threats.

- Reinforce Risk Management Practices: Investing in catastrophe preparedness, security protocols, and framework improvements can help in reducing insurance coverage costs over time.

- Utilize Industry Networks: Engaging visit with organizations that offer chamber of commerce membership can provide organizations with important sources, advocacy assistance, and group insurance choices.

- Explore Alternative Coverage Solutions: Self-insurance swimming pools, captives, and specialized plans might supply more affordable security for services facing high premiums.

- Remain Informed on Legislative Updates: Monitoring state and government governing modifications can help businesses expect future changes and adjust their strategies as necessary.

The Future of Business Insurance in California

While California's home insurance coverage reforms have presented obstacles, they additionally highlight the significance of strength and adaptability for businesses. As the regulatory landscape continues to advance, remaining proactive, informed, and engaged with market teams will certainly be crucial for long-term success.

Company owner that put in the time to evaluate their insurance coverage needs, enhance danger administration approaches, and leverage the benefits of chamber of commerce membership will certainly be better placed to browse these changes. The key is to stay versatile and aggressive in resolving insurance policy concerns while focusing on long-term growth and security.

For even more understandings on exactly how these insurance reforms will certainly remain to shape California's company setting, remain tuned for updates on our blog. We'll maintain you informed with professional analysis, regulative information, and practical strategies to help your service prosper.

Shaun Weiss Then & Now!

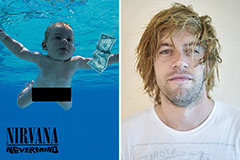

Shaun Weiss Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!